Formal sector jobs are a small share of the total hires by unicorns in India and employment trends in the space have been fluctuating.

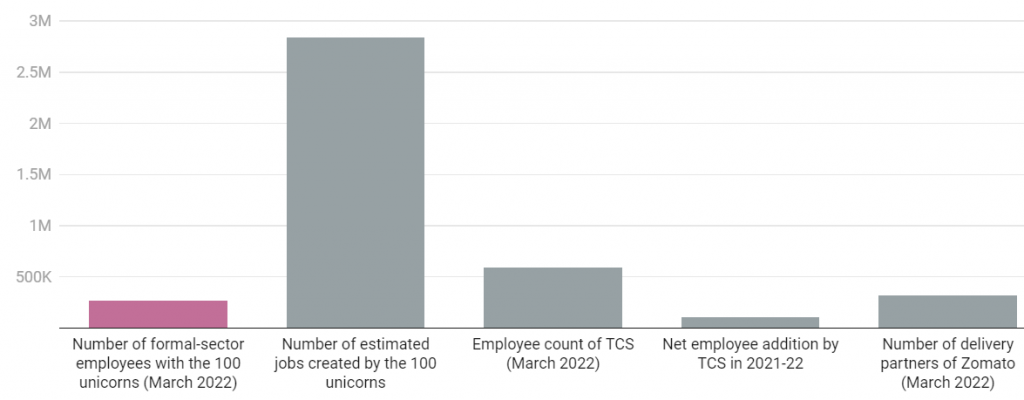

When it comes to employment, the 100 Indian companies that have ever been unicorns are more about the informal sector than the formal sector. Their regulatory filings with the Employees’ Provident Fund Organization (EPFO) show they deposited provident fund for about 272,000 employees in India this March, about a tenth of the total number of jobs they have created.

This is about 46% of the workforce of Tata Consultancy Services, India’s largest private-sector employer, and about 50,000 less than the entire force of delivery partners of Zomato, one of these unicorns. The remaining jobs, which are in the informal sector, are presumably in “ancillary areas such as contractual employment, content creators, tutors, delivery partners, and drivers, among others”, according to YourStory. It estimates that these unicorns have created 2.84 million jobs in all.

India’s 100 Unicorns Employ Less Than Half Of India’s Largest Private-Sector Employer, TCS

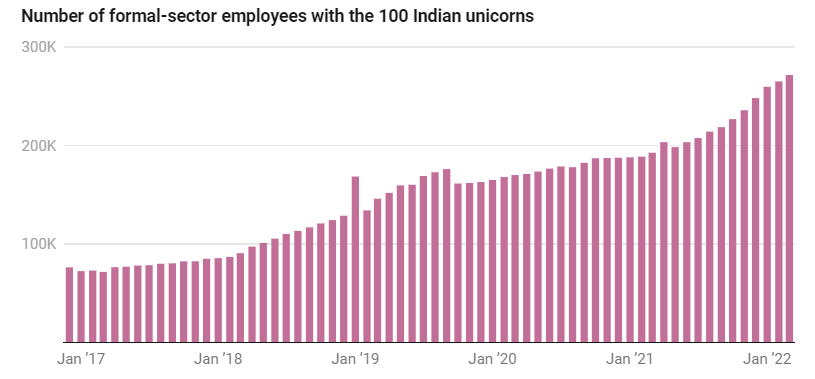

It could come under pressure as more unicorns lay off employees amid funding woes. Over the past five years, employment in the formal sector among these 100 unicorns has been mostly a growth story. The highest year-on-year growth was in 2018-19, which stood at 54%. The only significant break was between September 2019 and March 2020, which coincided with the outbreak of COVID-19. During this period, the number of formal sector employees with these 100 unicorns fell by about 3%. Since then, however, it has expanded by 60%. For March 2022, it has again declined by around 2%. However, with companies filing EPFO returns late, the numbers may be revised and the actual extent of layoffs will be clear only after one to three months.

Barring A Brief Dip During End-2019, India’s Unicorns Have Consistently Grown In Formal-Sector Employees

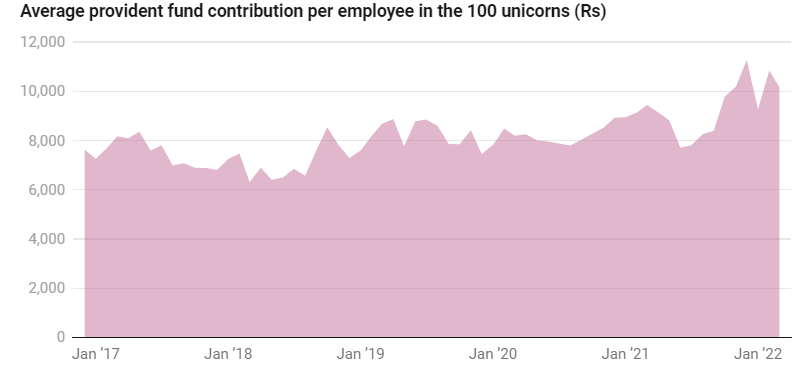

Typically, formal sector employment provides employees with benefits related to social security, leave and insurance. It is also the basis for attracting talent into more efficient jobs. Given the paucity of good talent and the urgency to grow rapidly, these 100 unicorns have seen an increase in average salaries over the past year or so.

This is in contrast to 2017-18, when Unicorn’s workforce increased, but the average provident fund (PF) contribution per employee fell. 7,466 to 7,125. The average contribution here includes the 12% component of both the employee and the employer. Over the course of the year, this indicates a 5% decline in average basic pay, which may be due to more appointments at the base of the pay pyramid. In 2018-19, which is in line with the high growth among Unicorn employees, the average PF contribution increased by 16%. In 2022, the average PF contribution increased by 18% as compared to 2021. This is a 40% increase in the average basic pay as compared to 2017.

Average Provident Fund Contributions By These 100 Unicorns Have Increased In The Past Year, Indicating Rising Salaries

From the field point of view, the unicorn landscape has seen significant changes in the last five years. Take ecommerce. In January 2017, the sector accounted for 21.3% of all formal sector employees among 100 unicorns. Its stake was reduced to 12.9% in April 2022. Three more key sectors that have seen major declines in the stock are grocery, travel and ride hailing.

Through the acquisition, groceries have been incorporated into FoodTech and e-commerce. But travel and ride-hailing have shrunk. Oyo’s workforce was around 18,000 in 2019-20, but now it is only 3,000. Similarly, Ola, India’s only unicorn in ride hailing, has fallen from 4,200 employees in 2017 to 1,600 in April 2022. The biggest beneficiary of the startup and funding boom has been education technology, or EdTech, whose headcount has grown from 2,200 in December 2016. Around 65,000 in March 2022. And now it’s also the basis for the biggest cut reported layoffs at Unacademy and Vedantu.

(Source: www.livemint.com)