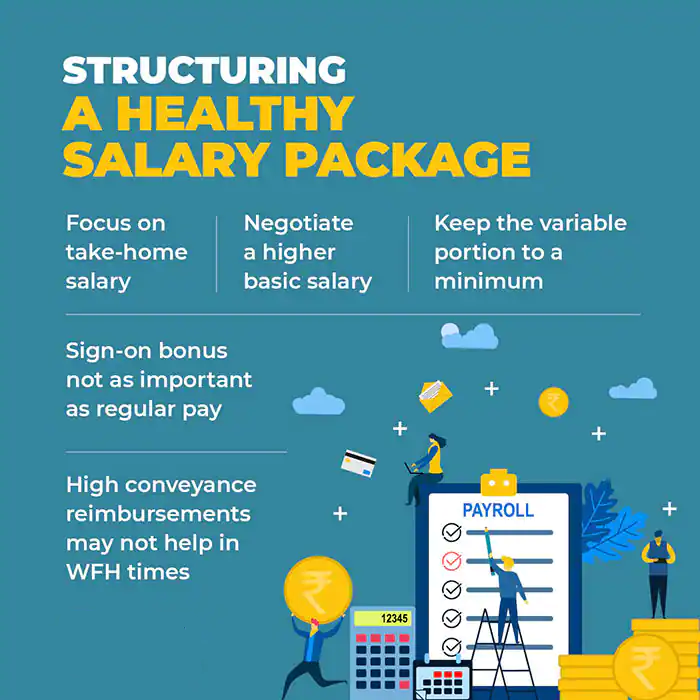

Do not be swayed by a seemingly large gross remuneration package if conveyance reimbursement, variable pay and insurance premium make up a major part of it

Consider this: Fresh out of college, you receive two job offers. One company gives a fixed annual salary of Rs 2.5 lakh, without any variable component. Another firm offers you a salary (CTC or cost-to-company) of Rs 4 lakh, including a signing bonus of Rs 1 lakh and performance-linked incentive of up to Rs 1 lakh. Which of the two companies would you join?

Such dilemmas are common. Here are some pointers to make the right choice.

Bonuses look attractive on paper

With information technology (IT) majors as well as tech start-ups, among others on a hiring spree, fresh graduates and junior-level professionals seem spoilt for choice at the moment. According to a report, companies’ intent to hire fresh graduates has increased by 7 percentage points in the current quarter (July-September 2021).

Focus on your take-home pay

To ensure that you get the take-home pay – the actual amount credited to your bank account – that you think you deserve, you need to first arrive at a convincing figure. Meticulously calculate your monthly essential spends such as fuel, food, rent and EMIs. It will help you ascertain the minimum take-home salary that you would need every month.

Higher basic salary good for your retirement kitty

A higher basic salary helps. Ideally, it should not be less than 50 percent of the total gross remuneration. This will ensure that a higher amount is directed towards your employees’ provident fund account. A higher basic salary means higher inflow into your retirement fund. Employers deduct 12 percent of your basic (and dearness allowance, if applicable) as your contribution to EPF every month. They also have to match the contribution, from which 8.33 percent goes towards the employees’ pension scheme (EPS). These measures act as forced savings for employees, helping them create a sizeable kitty for their retirement. It should matter more than other benefits offered.

Factor in COVID-19-induced work-from-home setting

Check how conveyance expenses will be treated, particularly in the context of remote, work-from-home framework. “For example, in the case of sales jobs, employees could be entitled to daily allowances that are paid upon submission of bills. But due to COVID-19-driven restrictions, the number of field visits has gone down, affecting the reimbursement amount claimed,” explains Mishra. So, if your employment contract states that your reimbursement would be the lower of the limit specified or actual expenses incurred, your in-hand remuneration would stand reduced.

Similarly, check if the company will pay cash instead of the promised food reimbursement till you work from home. In the current environment, if reimbursements form a large chunk of your CTC, you could be at a disadvantage.

Evaluate insurance benefits, too

Many offices offer life and health insurance covers. You can’t bargain much on those, but it pays to know the benefits that the company may have to offer. The fact is that a health insurance policy primarily covers hospitalisation and day care expenses. So, do not make the mistake of treating it as a kitty that you can dip into for funding routine medical expenses.

(Source: www.moneycontrol.com)